does georgia have estate or inheritance tax

You can use the advance for anything you need and we take all the risk. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you.

Yes as Georgia does not tax Social Security and provides a deduction of 65000 per person on all types of retirement income for anyone age 65 and older.

. Estate Planning Last Wills Last Will State Requirements Living Trusts Living Wills Estate Planning Basics Inheritance Cases. Impose estate taxes and six impose inheritance taxes. If your probate case does not pay then you owe us nothing.

Living trusts can be excellent estate planning tools but they arent necessarily going to protect your assets. Estate Planning Last Wills Last Will State Requirements Living Trusts Living Wills Estate Planning Basics Inheritance Cases. You must file a copy of the federal return with payment for the Georgia tax.

Even though Texas does not have an estate or inheritance tax there are instances when such taxes are applied to inheritances in Texas. Twelve states and Washington DC. Our network attorneys have an average customer rating of 48 out of 5 stars.

If youre age 62 to 64 this deduction drops to 35000. Top Get helpful tips and. The tax is paid by the estate before any assets are distributed to heirs.

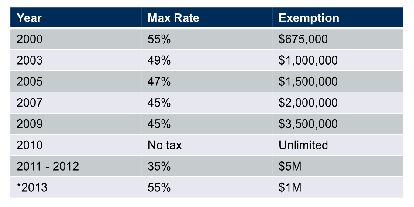

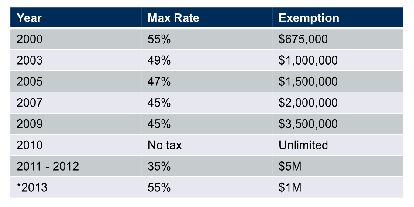

There is no obligation. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Meanwhile the states sales tax rate and property tax rate are both relatively moderate and there are no inheritance or estate.

Maryland is the only state to impose both. For example there may be cases when a property is located in a state where estate and inheritance taxes exist and taxes will be. Of the six states with inheritance taxes Nebraska has the highest top rate at 18 percent.

It is not paid by the person inheriting the assets. Getting your estate in order may sound daunting but it doesnt have to be. Georgia does not have an estate tax form.

Compare state estate tax rates and state inheritance tax rates below. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Your credit history does not matter and there are no hidden fees.

All six states exempt spouses and some fully or partially exempt immediate relatives. Marylandwhich also has an estate taximposes the lowest top rate at 10 percent. Our network attorneys have an average customer rating of 48 out of 5 stars.

Top Get helpful tips and info from our. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Key Essentials For Estate Planning

Bitlife On Twitter Richie05d More Than Half Of The Countries In The Game Don T Have Estate Tax We Are Just Following Real Rules Twitter

Center For State Tax Policy Tax Foundation

Retirement Optimizer A Strategy For Life By Brian Weatherdon Via Slideshare Life Retirement Strategies

Inheritance Tax Here S Who Pays And In Which States Bankrate

5 Ways The Rich Can Avoid The Estate Tax Smartasset

Wait Consider The Tax Consequences Before You Purchase A Vacation Home In The Us Property Taxes Canada

Real Estate Educate Pristine Properties

State Estate And Inheritance Taxes Itep

State By State Comparison Where Should You Retire

Estate Planning 101 Your Guide To Estate Tax In Georgia

New Irs Requirements To Request Estate Closing Letter

Inheritance Tax Here S Who Pays And In Which States Bankrate

U S Estate And Gift Tax Revenue And Forecast 2032 Statista

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of T Last Will And Testament Will And Testament Mocking